RETAIL DONE RIGHT

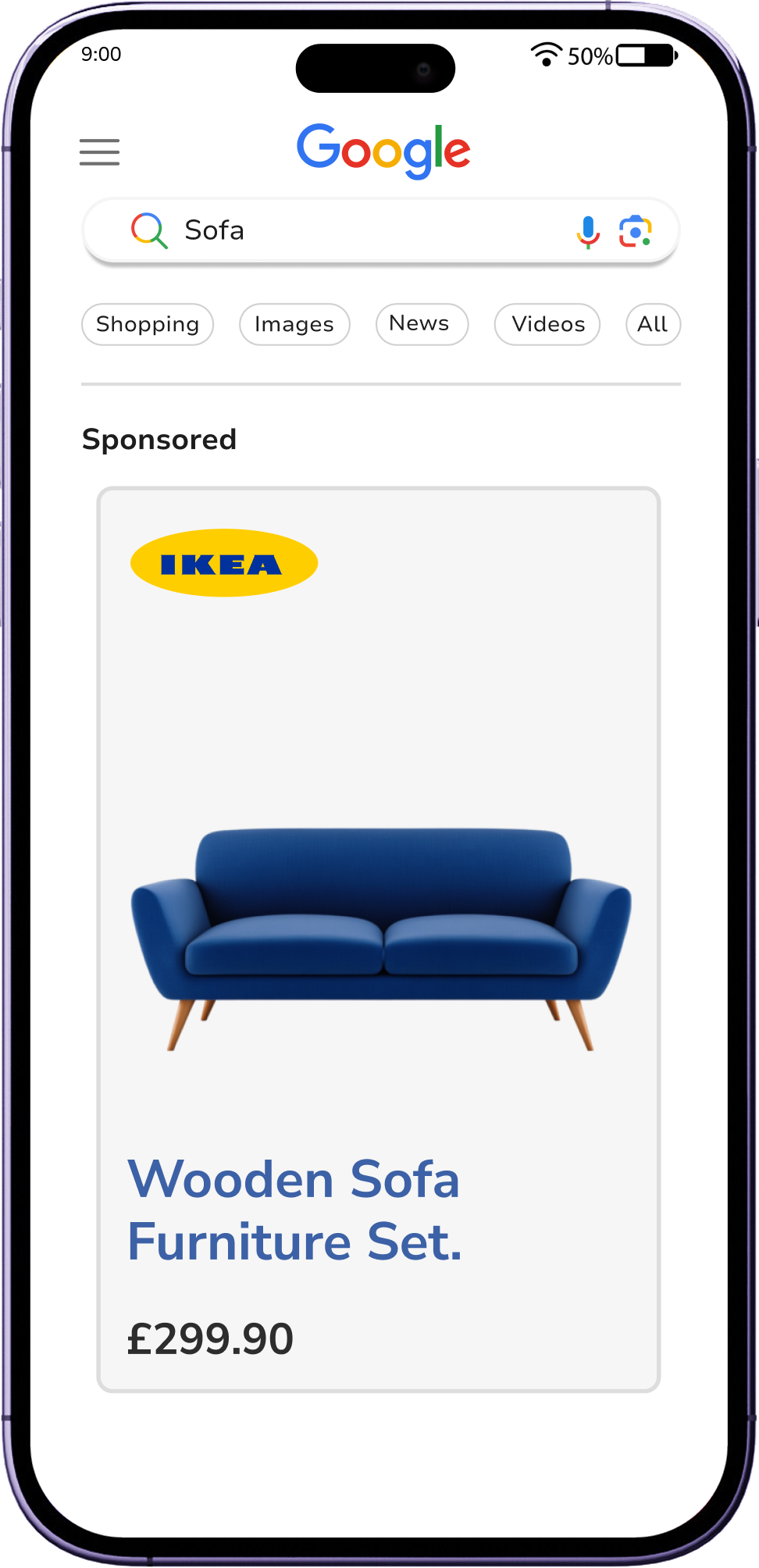

GOOGLE SHOPPING CSS DISCOUNT

#1 Shopping Feed + Ad Platform

DEMO

Reduce Cost

Reduce your costs instantly. Discount applied to your Google Merchant Center Account

Keyword Insights

As Google is taking away Keyword Insights, we, as Google technology partners, are bringing it back so you can see performance data at the product level.

Keyword Targeting

Target the right type of keywords. Stop relying on Google to spend money on your behalf.

Retail Bidding

Maintain control of product performance with specific retail bidding strategies: those that complement Google bidding rules.

Competitor Bidding

Increase product bids if you are cheaper than your competitors or if your competitors are out of stock.

Save Permanently

20% Discount On Your Google Shopping Spend

Our clients get a permanent 20% discount on their Google Shopping spends. This is applied automatically without any changes needed. Start saving instantly. Furthermore, at ShoppingIQ, we have also developed new targeting strategies to reduce your spend further with improved keyword search to product matching. This is applied through advanced product feed management techniques and additional optimisations not available in platforms like Google Merchant Center and Google AdWords.

Take full control of how your products show and focus your ad spend on your profitable keywords and products.

Powerful real-time, game-changing optimisations not available anywhere else to get you listed more efficiently, improve targeting and stay ahead of the competition.

Why us?

What makes us #1?

We are Google Technology Partners

We are Google partners. We understand the issues and limitations of Google Merchant Centre, Google Adwords and other shopping technologies. We solve these issues allowing start ups and global advertisers to instantly save money and improve results.

Powerful Ad Platform

We have developed proprietary technology number to solve the various issues that come with popular products feeds from Google and Facebook. Our platform is totally designed for retail and we offer solutions, features and optimisations available no where else.

Frequently Asked Questions

Why does Google offer this discount?

Google legally has to offer this discount to it’s CSS partners due to the support CSS provide, and for Google to maintan its integrity and position legally. The ShoppingIQ CSS give you all the benifits of a CSS plus more. For more information, please see the article published by eConsultancy.